Instructions for user login

1. Please follow the process given below

- Enter valid User Id.

- OR Enter valid Case No.

- Enter valid verification code as given in captcha image.

- Verification code is not case sensative.

- Click on Login button

2. Once you login with valid credential you will be redirected to your Dashboard where multiple action can be done.

MSME SAMADHAAN- Delayed Payments to Micro and Small Enterprises under Micro, Small and Medium Enterprise Development (MSMED) Act, 2006

Related Provision

The Micro, Small and Medium Enterprise Development (MSMED) Act, 2006 contains provisions

of Delayed Payment to Micro and Small Enterprise (MSEs). (Section 15- 24). State

Governments to establish Micro and Small Enterprise Facilitation Council (MSEFC)

for settlement of disputes on getting references/filing on Delayed payments. (Section

20 and 21)

Nature of assistance

MSEFC of the State after examining the case filed by MSE unit will issue directions

to the buyer unit for payment of due amount along with interest as per the provisions

under the MSMED Act 2006.

Who can apply

Any Micro or small enterprise having valid Udyam Registration can apply.

Salient Features

The buyer is liable to pay compound interest with the monthly rests to the supplier

on the amount at the three times of the bank rate notified by RBI in case he does

not make payment to the supplier for his supplies of goods or services within 45

days of the acceptance of the goods/service rendered. (Section 16)

State Governments to notify (i) Authority for filing Entrepreneur Memorandum (ii)

Rules of MSEFC and (iii) Constitution of MSEFC.

All States/UTs have notified Authority for Filing Entrepreneur's Memorandum, have Notified rules

of MSEFC and all the 37 States/UTs have constituted MSEFCs, as per provisions laid

down under MSMED Act 2006.

Every reference made to MSEFC shall be decided within a period of ninety days from

the date of making such a reference as per provisions laid in the Act.

If the Appellant (not being the supplier) wants to file an appeal, no application

for setting aside any decree or award by the MSEFC shall be entertained by any court

unless the appellant (not being supplier) has deposited with it, the 75% of the

award amount. (Section 19)

Implementation

The provisions under the Act are implemented by MSEFC chaired by Director of Industries

of the State /UT having administrative control of the MSE units. State Government/UTs

are requested to ensure that the MSE Facilitation Council hold meetings regularly

and delayed payment cases are decided by the Councils within a period of 90 days

as stipulated in the MSMED Act, 2006.

MSME Samadhaan Portal - Ease of filing application under MSEFC, an Initiative from Ministry of MSME, Govt. of India

Ministry of MSME has taken an initiative for filing online application by the supplier MSE unit against the buyer of goods/services before the concerned MSEFC of his/her State/UT. These will be viewed by MSEFC Council for their actions. These will be also visible to Concerned Central Ministries, Departments, CPSEs, State Government, etc for pro-active actions.

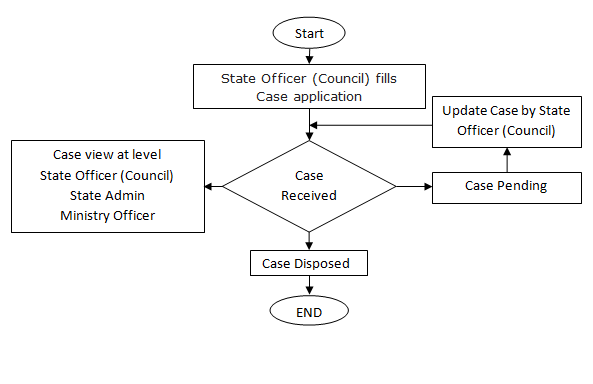

Flow of Scheme